Hello there it is Thursday, September 12 2009, teen, and we are here with our friend and colleague Michael layman law firm uh John Beck my partner is also here with us, and we're going to talk about form 10:23 line by line first let me mention that next Thursday we have the amazing Colleen Flynn she's going to talk about the ten practical and legal strategies for hiring employees and then the following week once you've got them hired she's going to tell you how to terminate them on September the 26, so please sign up for that Colleen is a great presenter with a lot of good practical advice and then Barry Flag is going to talk about the New York best interest rule for life insurance which is setting a national fiduciary standard that's going to apply to all life insurance agents at least in front of juries, and you're going to learn a lot about life insurance and practicalities thereof from one of the best skeptics in the industry Barry Flag we have other presentations coming up you can see on pages 5 & 6 but let me get to Michael layman Michael is one of the most talented and well qualified tax lawyers who specialize in practices only almost exclusively in the not-for-profit area this includes not-for-profit healthcare social service agencies alcohol and substance abuse centers scientific research organizations religious organizations museums he has a lot of knowledge in a very well hidden area and John Beck and I recently did a lot of work for a very charitable client, and we were surprised number one at how hard it is to learn about this area how little there is in the books and outlines and treatises and secondly how knowledgeable Michael was so Michael...

PDF editing your way

Complete or edit your IRS 1023 2017 Form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export IRS 1023 2017 Form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your IRS 1023 2017 Form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your IRS 1023 2017 Form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare IRS 1023 2025 Form

About IRS 1023 2025 Form

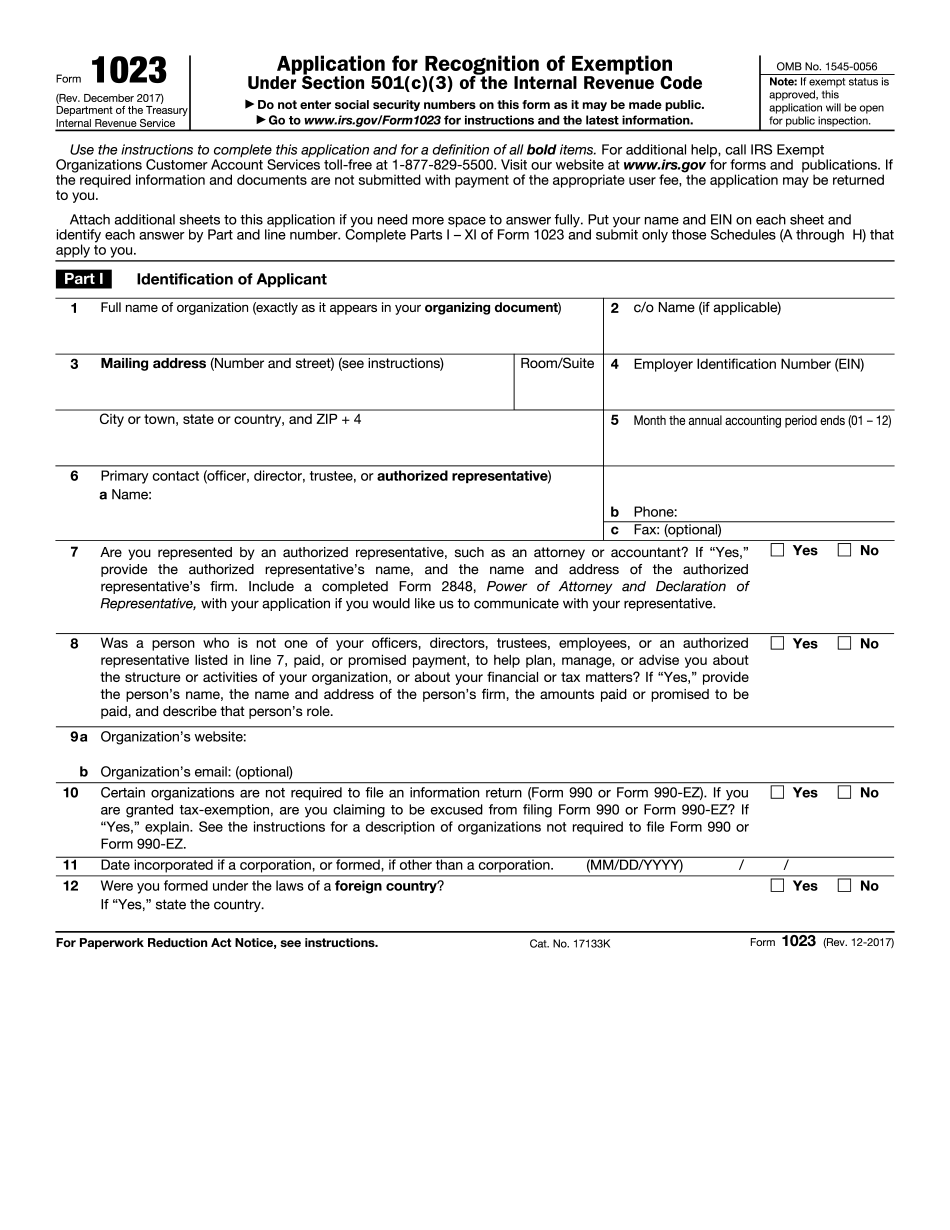

The IRS 1023 2025 Form is an application for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. It is used by organizations seeking to be recognized as tax-exempt charitable organizations by the Internal Revenue Service (IRS) in the United States. The form requires detailed information about the organization, including its purpose, activities, financials, governance, and fundraising methods. It also requires the submission of supporting documents, such as the organization's articles of incorporation, bylaws, and financial statements. Nonprofit organizations that intend to operate as charitable organizations and qualify for tax-exempt status under section 501(c)(3) of the Internal Revenue Code must file the IRS 1023 Form. This includes organizations engaged in religious, educational, scientific, literary, charitable, or other specified activities. It is important to note that the 1023 Form is quite lengthy and complex, requiring careful completion and thorough documentation. The approval process can also take several months, with the IRS carefully reviewing the application to ensure compliance with the requirements for tax-exempt status.

Online options assist you to coordinate your own document management and also boost the efficiency of your workflow. Stick to the rapid information to complete IRS 1023 2025 Form 1023 Instructions, prevent problems and adorn the idea on time:

How to finish the IRS 1023 2025 Form 1023 Instructions on the internet:

- On the website with the document, just click Start Now along with move on the editor.

- Use the actual clues to be able to complete the relevant job areas.

- Include your own personal data and contact info.

- Make sure that one enters correct info and also quantities in appropriate areas.

- Wisely confirm the content with the file and also sentence structure as well as punctuation.

- Refer to Help part if you have questions or perhaps deal with the Help team.

- Put an electric personal on your IRS 1023 2025 Form 1023 Instructions with the aid of Signal Instrument.

- After the form is finished, click Accomplished.

- Deliver the actual all set PDF by means of e-mail as well as send, printing against each other as well as reduce your device.

PDF writer permits you to create changes on your IRS 1023 2025 Form 1023 Instructions through the web attached unit, personalize it in accordance with your requirements, sign this electronically as well as send out in different ways.

What people say about us

The increasing need for electronic forms

Video instructions and help with filling out and completing IRS 1023 2025 Form